SERVICES

CUSTOMS AUDIT CONSULTING SERVICE

What is

Customs Audit?

The customs audit is a comprehensive examination of all import and export activities, including the accuracy of the declared

tax amount and customs requirements stipulated in relevant statutes.

Types of Customs Audit

STEP 01

Corporate Audit

(Regular Examination)

(Regular Examination)

Examination on the overall

legality of customs clearance

of firms that fit in specific

standards including the

import and export volume

on a regular basis.

legality of customs clearance

of firms that fit in specific

standards including the

import and export volume

on a regular basis.

STEP 02

Project Audit

(Irregular Examination)

(Irregular Examination)

Examination on the legality of

customs clearance of firms

that are selected on the basis

of analysis on the basic

planning of project audit and

customs clearance legality

customs clearance of firms

that are selected on the basis

of analysis on the basic

planning of project audit and

customs clearance legality

STEP 03

Comprehensive

Examination

(Regular Examination)

Examination

(Regular Examination)

Examination of the status of

implementation of AEO certified

standards and the field of

clearance legality for AEO

enterprises from 2 years

after the accreditation to

6 months before the expiration

implementation of AEO certified

standards and the field of

clearance legality for AEO

enterprises from 2 years

after the accreditation to

6 months before the expiration

STEP 04

Other Customs Refund

Examinations

Examinations

Examination on whether

the customs refund application

requirements are satisfied

and the calculation of the

required amount is suitable

in accordance with

the Customs Act and

the Special Act on Refunds

the customs refund application

requirements are satisfied

and the calculation of the

required amount is suitable

in accordance with

the Customs Act and

the Special Act on Refunds

Subject Items for Corporate Audits

| Customs Valuation and the Dutiable Value |

|

|---|---|

| Classification and Tariff Reduction/Exemption |

|

| Compliance with Foreign Exchange Transaction Act |

|

| Legality of Country of Origin and Customs Clearance |

|

| Customs Refund |

|

| Import Requirements |

|

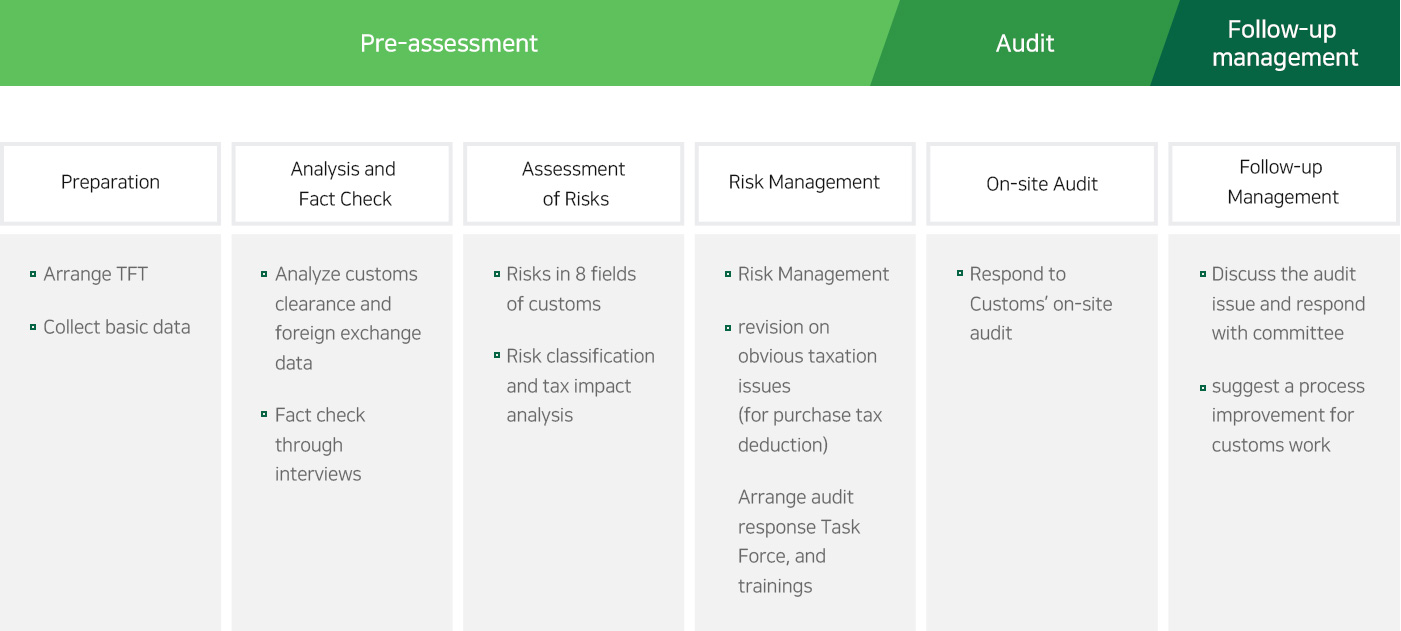

Consulting Process

KOR

KOR ENG

ENG