SERVICES

ACVA CONSULTING

Our Distinctive ACVA Services

through Abundant Experiences in

Customs Valuation Consultings for

Various Foreign Companies

We provide support in every process from application to approval for the ACVA (Advance Customs Valuation Arrangement for transactions

between related parties), a system determining the customs value of imported goods in advance,

for transactions between related parties through mutual agreement between taxation authorities and taxpayers upon the application of taxpayers.

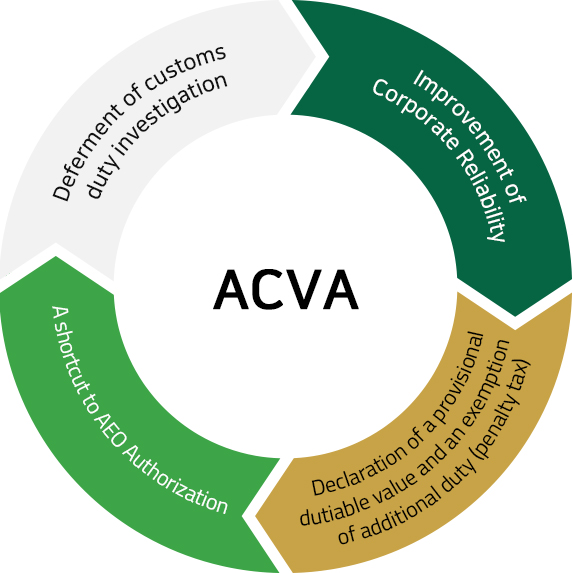

ACVA Benefits

-

01Deferment of customs

duty investigationCustoms duty investigation is deferred with

respect to the dutiable value of the goods

on which ACVA has been applied for, from

the time of application to the time

of approval. For 3 years from

the time of approval, the declared

value is accepted as the dutiable value. -

02Improvement of Corporate

ReliabilityACVA approved firms are more competitive

by earning trust from consumers and

taxation authorities in the price of the

imported goods. -

04A shortcut to

AEO AuthorizationACVA approved firms can be authorized

for AEO with ease. AEO authorization

provides benefits such as quick customs

clearance domestically and in foreign

countries as well. -

03Declaration of a provisional

dutiable value and

an exemption of additional

duty (penalty tax)As any ACVA applicant can use

theprovisional value declaration system

from the date of ACVA application,

the applicant will be exempt from additional

duty if the dutiable value of goods is

changed to the value approved by ACVA.

Major Points for ACVA

-

01

whether the special relationship has influenced

the transaction price or not -

02

whether the dutiable value determination method

(one of the first to sixth method) applied for is valid or not - 03 whether there are any factors of addition or deduction or not

- 04 whether the dutiable value is appropriate or not

-

05

whether the internal tax authorities approve the advanced

pricing arrangement (APA) or not, or recognize the dutiable

value determination method applied for or not

ACVA Procedure

-

STEP 01

Prior

Prior

Consultationapply for a prior

consultation in advance

if necessary -

STEP 02

Application for

Application for

Prior Examinationbase data for the

method of determining

the price of

imported goods,

such as the previous

price policy or report,

the contract, etc. -

STEP 03

Prior

Prior

Examination1 year of examination

-

STEP 04

Notification of

Notification of

Examination ResultsUpon the receipt of

notification of

examination results,

the applicant notifies

either agreement or

disagreement

to the results -

STEP 05

Issuance of Advanced

Issuance of Advanced

Examination

CertificateValid thorugh 3 years

-

STEP 06

Submission of an

Submission of an

Annual ReportSubmit an annual

report to the

KCS Headquarters

every year.

Service Scope

-

01

Analyze

the influence on

transaction prices

between related

parties before the

ACVA application -

02

Represent

ACVA application -

03

Assist preparation

for all supporting

documents

of the

ACVA application -

04

Support annual

report preparation

and

post management

after

ACVA approval

KOR

KOR ENG

ENG