SERVICES

CUSTOMS REFUND SERVICE

Overview of

Customs Duties

Refund

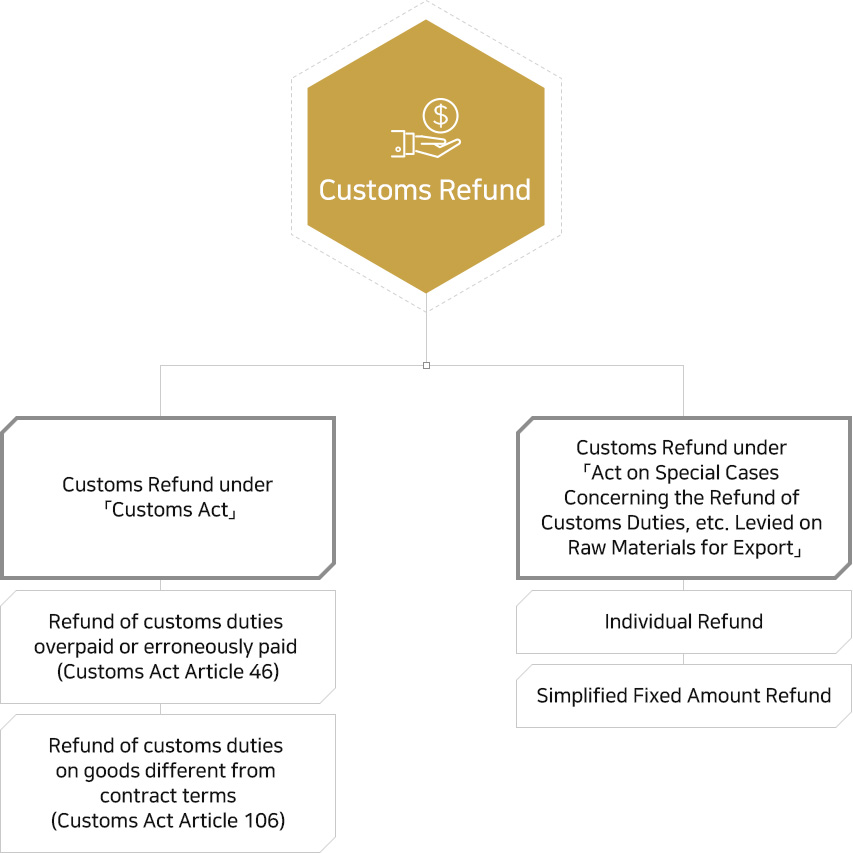

Customs Refund refers to the ‘return of the duties initially paid to Custom. The refund can be applied for certain reasons

stipulated in the statutes, and the types of refunds can be categorized depending on the reasons – refunds under the

「Customs Act」 and refunds under the 「Act on Special Cases Concerning the Refund of Customs Duties, etc. Levied on

Raw Materials for Export」. Refund under the 「Customs Act」 are refunds of 1) customs duties overpaid or erroneously

paid, and 2) customs duties on goods different from contract terms. Refund under 「Act on Special Cases Concerning

the Refund of Customs Duties, etc. Levied on Raw Materials for Export」, however, refunds the customs duties that have

been initially paid when importing the raw material for export, to the exporter or producer when exporting the exporting

goods, in order to increase the international price competitiveness of the exporting goods.

Types of Customs Refund

Methods for Customs Refund

Customs Refund under 「Act on Special Cases Concerning the Refund of Customs Duties, etc. Levied on Raw Materials for Export」

can be divided into two types: Individual Refund and Simplified Fixed Amount Refund

| Methods | Characteristics |

|---|---|

| Individual Refund |

This is a method of checking the name, specifications, and quantity of the raw materials used in the manufacturing of the

|

| Simplified Fixed Amount Refund |

This method has been implemented to simplify the refund process in order to encourage the exportation of small and

|

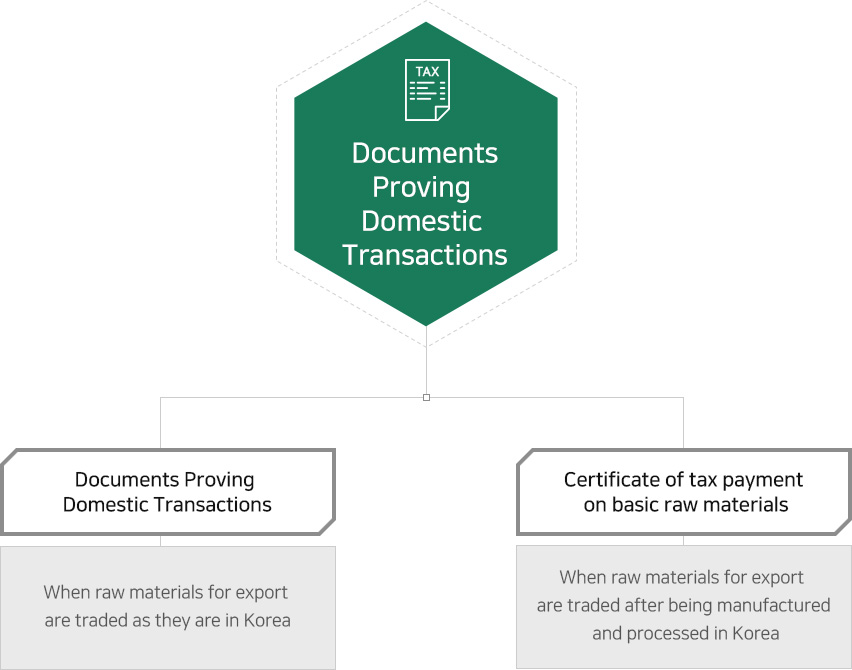

Domestic Transaction Proof System for Raw Materials for Export

Although the transaction of raw materials is made domestically, if the materials are used for final products

to be exported, customs refund can be claimed with supporting documents on such transactions.

- Certificate of tax payment on basic raw materials

-

A system to certify the tax amount paid, including the import duty

on imported raw materials, after providing the finished products

to the exporter or producers of exported goods (including the

producers of processed raw materials)

- Certificate of Divided Import Tax Amount

-

A system to certify the tax amount paid – including the import duty on

imported raw materials, after providing the raw materials in the same

condition as they were imported (as they were purchased if they are

produced domestically) – to the exporter or producers of the exporting

goods (including the producers of processed raw materials)

Customs Refund Audit

determines the refund amount by reviewing the details on the refund application.

The accuracy and legality of the refund is reviewed after the refund is paid.

Post Audits of Customs Refund must be finished in 5 years from refund application date in principle, except in cases

where the head of Korea Customs Service determines otherwise. When the Customs selects the subjects

for post-audits, there is an automatic selection method by customs refund system, and a manual selection

method of Customs by considering the characteristics of each applicant.

Major Items in Customs Refund Audit

-

01Whether the export is subject to refund or not

-

02Whether the used material corresponds to the material

subject to refund or not -

03Whether the refund was applied for the same standard

materials used in the production of goods for export or not -

04Whether the calculation of yield and yield ratio is accurate or not

-

05Whether the by-product is generated and the calculation

of the deduction ratio for a by-product is appropriate or not -

06Whether the refund is limited or not; and whether other items related to the calculation of the refund is appropriate or not.

KOR

KOR ENG

ENG