SERVICES

CUSTOMS CLEARANCE SERVICE

Overview

of Import

Clearance

The term "import" means shipping foreign goods into the Republic of Korea (referring to any foreign goods shipped

from the bonded area in Korea in cases of those passing through the bonded area) or consuming and using them

(referring to the consumption and use of foreign goods within the means of transportation, but excluding the consumption

and use of foreign goods falling under any of subparagraphs of Article 239 in Korea.)

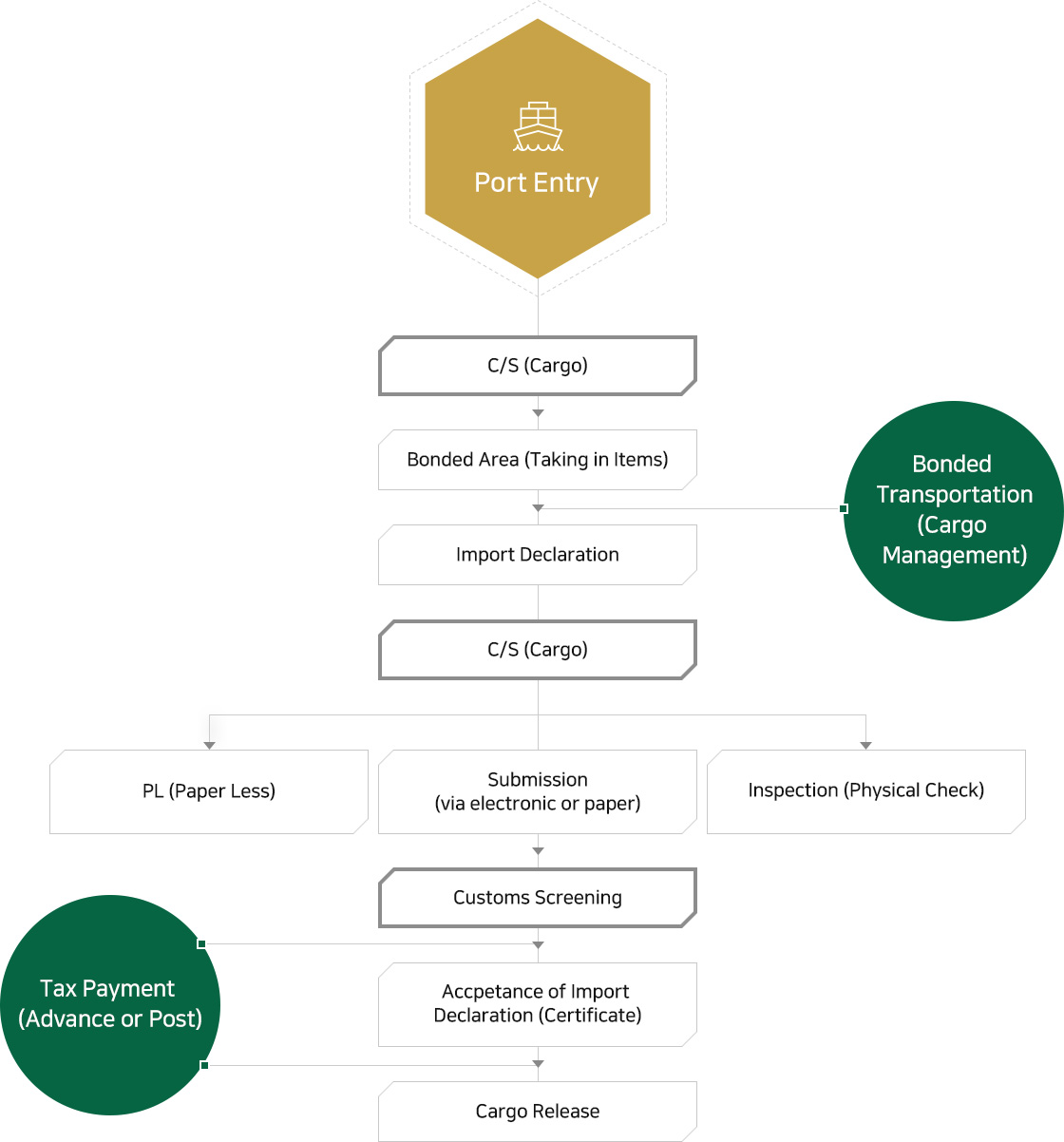

Import clearance is a series of processes;

a person intending to import goods files declaration to Customs authority (① before the departure of the goods from

the exporting country, ② before the port entry, ③ after port entry and before the goods arriving at the bonded area,

④ After stored at the bonded area) and the head of a customs office accepts the declaration and provides certificate

of the acceptance for the import declaration, only when the declaration has legally and justly been filed in accordance with

the Custom Act and other relevant laws, allowing the goods to be released.

Import Clearance Procedures

Relevant Systems

-

01Customs Duty

Reduction/Exemption

System -

- Customs duty reduction/exemption means reducing part of or the entire customs duty for goods that fulfill

certain conditions, in order to achieve national administrative purpose. - As reduction/exemption of customs duty could differ even within identical goods, depending on the purpose,

condition, time of import declaration and applied regulations, the import declaration should be accurately filed,

and the importer should apply for the customs duty reduction/exemption before the import declaration acceptance. - Reduction/exemption of customs duty is divided into two types: a conditional reduction/exemption, requiring a

specific use of a product, and unconditional reduction/exemption. Any goods whose customs duties are reduced

or exempted with a condition cannot be used for other purposes and cannot be transferred/leased without the

permission of the head of the customs office for a certain period of time. To enforce the system, a post

management is being implemented.

- Customs duty reduction/exemption means reducing part of or the entire customs duty for goods that fulfill

-

02Country of Origin

Indication System -

- “Country of Origin” means the nationality of the imported/exported goods, which refers to the country where

the goods have been grown, produced, manufactured, or processed. - Korea’s country of origin indication system has been implemented since 1st, July of 1991 with 「Criteria for

Assessment of Origin of Imported or Exported Goods」, 「Goods Subject to Marking of Origin」 and 「Penalties for

Breach of Regulations」 illustrated in the Foreign Trade Act. -

In addition, The Customs Act operates as a system for the final consumers in Korea, with regulations concerning

the identification of the country of origin and their marks during customs clearance processes and crackdowns

on commercial distribution processes.

- “Country of Origin” means the nationality of the imported/exported goods, which refers to the country where

-

03Other

Import Clearance

System -

- With our abundant work experience and expertise manpower, SEIN can provide the following services as well.

-

-

Declaration of provisional and final dutiable values

-Release prior to the

acceptance of declaration-Post-application of FTA

-

-

Carnet Entry

-Customs clearance of

international postal

items(EMS)-Travelers’ Baggage

Declaration (Hand Carry) -

-

B/L split, etc.

Overview

of Export

Clearance

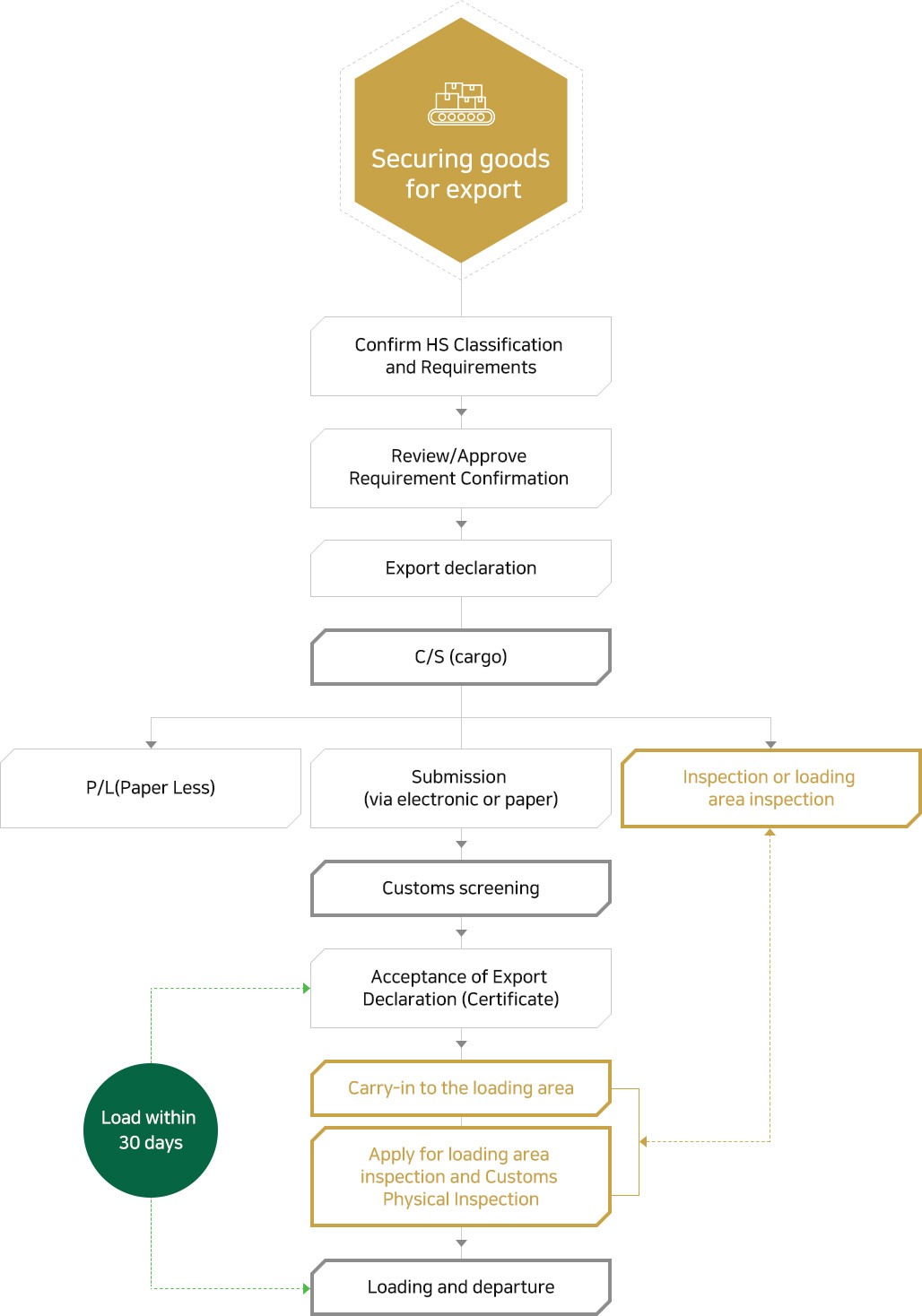

Export, under the Customs Act, refers to the transfer of goods(domestic goods) within national border(customs tax line).

A person who intends to export goods, shall declare names, standards, quantities, prices, and other matters of relevant

goods to the head of a customs office, and load them onto a means of transport within a given period – this process is

called an export clearance. Declarations shall be filed by the name of the owner of goods, a certified customs agent, etc.

For a prompt and accurate customs clearance procedures, most of the export companies declare export through certi-

fied customs agents.

In principle, the inspection on exporting goods shall be omitted for a prompt export customs clearance, but in some

cases, inspections shall be carried out in exceptional cases, such as computerized screening inspections based on the

crime-ridden criteria. In this case, special attention should be paid to avoid detection of illegal exports, violations of

country of origin marks, or breach of intellectual property rights, which could lead to penalties according to relevant

laws, such as the Customs Act.

Export Clearance Procedures

Required Documents and Precautions for Export Clearance

-

01Basic Documents

-

- Commercial invoice / Packing list

- Supporting documents that prove the fulfillment of the obligation to satisfy the conditions prescribed

by statutes, such as permissions, approvals, etc.

-

02Precautions when

exporting -

-

dentification of the location of the goodsWhen intending to export goods, the goods must be declared to the head of the customs office having

jurisdiction over the location area of the relevant goods before loading them onto the means of transportation.

Therefore, location of the goods at the time of export declaration must be clearly identified and provided for

an accurate declaration. -

Deadline for loading the declared goodsOnce export declaration is accepted, the goods have to be loaded onto the means of transportation within

30 days from the declaration acceptance date. -

Customs Duties RefundTo receive a customs refund pursuant to 「Act on Special Cases Concerning The Refund of Customs Duties,

etc. Levied on Raw Materials for Export」, one must accurately check and declare customs refund related

items with Certified Customs Agents when declaring exports. -

Strategic ItemsThe head of Ministry of Trade, Industry, and Energy shall determin whether the goods are strategic items or not

pursuant to attached table 2,3 in Public Notification of Strategic Items, in accordance with Foreign Trade Act

and Multilateral International Import and Export Control. If the goods are determined to be strategic items,

they should be exported with export permission.

-

Confirmation of Carrying Into Bonded Area

Customs Duties, etc. Levied on Raw Materials for Export」,even if transactions have been made in Korea,

when export materials are delivered to bonded areas such as duty free shops, and bonded warehouses,

the transactions may be considered as an export subject to refund, and the customs duties, etc.

levied on raw materials for export may be refundable.

In these cases, the supplier can obtain a ‘Certificate of Carried-in Exporting Goods Subject to Refund’ by himself or through a Certified

Customs Broker when carrying in raw materials for export to bonded areas in accordance with Chapter 5

(Issuance of Certificate of Carry-in or Loading) of 「Public Notification for the Management of Customs Refund on Customs Duties, etc.

Levied on Raw Materials for Export (Public Notification on Managing Customs Refunds)」 ,and get the customs duties refunded.

Simplified Customs Clearance

for the items listed below, the export customs clearance procedure can be replaced by submission of the invoice,

a list of simplified clearance items or a list of postal items for the convenience and simplification of declaration,

and this is referred to as the Simplified Export Declaration.

- Items subject to Simplified

Export Declaration -

- Corpse or remains

- Goods taken out with a diplomatic pouch

- Materials dispatched from the Ministry of

Foreign Affairs and Trade to foreign

embassies and legations -

Goods carried out by the President of a

foreign country, etc. - Catalog, records, and documents

- Goods purchased by foreign tourists

- Goods under FOB 2,000,000 KRW,

not subject to refund

- Postal Items

-

- For postal items subject to simplified

declaration, list submission, examination,

or inspection can be exempted.

- For postal items subject to simplified

- Carried out Samples

-

-

Goods – such as samples, exhibition items, etc.

that a traveler carries out as his personal

effects – can be declared verbally, instead of a

formal export declaration.

However, when re-importation of such goods

is expected, the goods should be exported with

confirmation, by documents stating the

description, specification, and quantity

(such as invoices), from the customs officer

at the immigration counter.

-

Goods – such as samples, exhibition items, etc.

Return of Goods

back to a foreign country without undergoing import clearance, and the procedures

related to returns are referred to as return clearance.

form but altering the title to a return declaration form). Details on the return declaration procedures by return types are stipulated in

「Public Notification on Return Procedures」. Returned goods must be transported by bonded transportation, and

must be loaded on the means of transportation within 30 days. If the goods are not loaded within 30 days, it must be carried

out of the country or the declaration must be cancelled.

KOR

KOR ENG

ENG