FTA CONSULTING SERVICES

Current FTA status of Korea, Republic

| FTA | Effective since | |

|---|---|---|

|

Chile | 2004.4.1 |

|

Singapore | 2006.3.2 |

|

EFTA | 2006.9.1 |

|

ASEAN | 2007.6.1 (differ by countries) |

|

India | 2010.1.1 |

|

EU | 2011.7.1 |

|

Peru | 2011.8.1 |

|

USA | 2012.3.15 |

|

Turkey | 2013.5.1 |

|

Australia | 2014.12.12 |

|

Canada | 2015.1.1 |

|

China | 2015.12.20 |

|

New Zealand | 2015.12.20 |

|

Vietnam | 2015.12.20 |

|

Columbia | 2016.7.15 |

- EFTA

- :Switzerland, Norway, Iceland, and Liechtenstein (4 countries)

- ASEAN

- :Malaysia, Singapore, Vietnam, Myanmar, Indonesia, Philippines, Brunei, Laos, Cambodia, and Thailand (10 countries)

- EU

- : Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and UK.

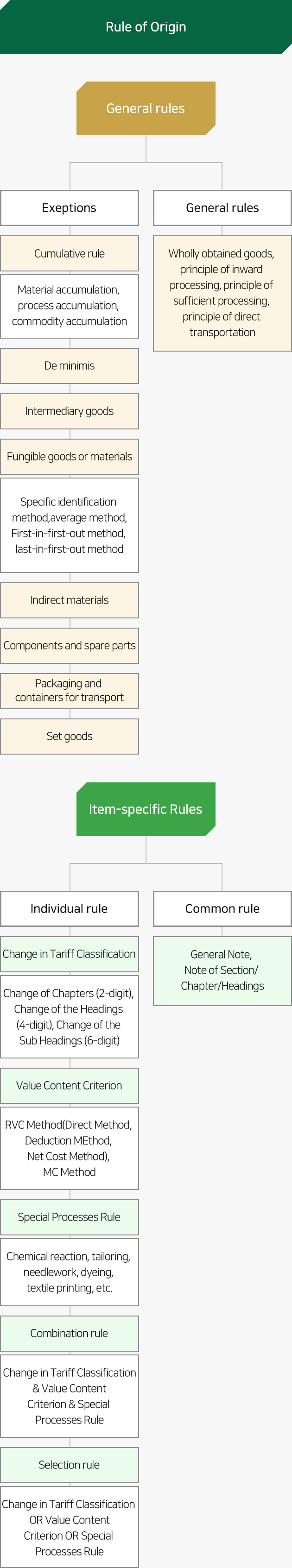

Rule of Origin

|

01

Definition of Country of Origin

|

|

02

The Rule of Origin Determination.

|

|

Certificate of Origin

FTA Certificate of Origin certifies that the exported goods meet the rule of the country of origin set by the FTA Agreement, and is applicable to preferential tariff rates. There are two types of certificate of origin depending on the method of issuance: Issuance by the authority, and Self Issuance

| Category | Chile | Singapore | EFTA | ASEAN | India | EU | Peru | Turkey | USA |

|---|---|---|---|---|---|---|---|---|---|

| Method of Issuance | Self-issuance | Issuance by the authority | Self-issuance | Issuance by the authority | Issuance by the authority | Self-issuance | Self-issuance | Self-issuance | Self-issuance |

| Issuer | Exporter |

*Customs *The Commerce of Commerce & Industry *Administration Agencyof Free Trade Zone |

Exporter | Government | Export Inspection Agency | Exporter/ Approved Exporter only for 6,000euro or more | Exporter | Exporter | Exporter, Producer, Importer |

| Certification Form | Unified Certification Form | Specific Certification Form | Invoice | Unified Certification Form (AK) | Unified Certification Form | Invoice | Unified Certification Form | Invoice | Recommended Form |

| Validity Period | 2 years | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 4 year |

| Language | English | Languages of each country | English | English, Korean | |||||

| Usage Count | Principle of Single Usage | Comprehensive issuance available within 12 months | |||||||

| Category | Australia | Canada | China | Vietnam | New Zealand | Colombia |

|---|---|---|---|---|---|---|

| Method of Issuance | Self-Issuance / Issuance by the authority | Self-Issuance | Issuance by the authority | Issuance by the authority | Self-Issuance | Self-Issuance |

| Issuer |

*Exporter/Producer *Australian Authority |

Exporter/Producer | *Chinese Authority *Korean Authority |

*Vietnamese Authority *Korean Authority |

Exporter/Producer | Exporter/Producer |

| Certification Form | Standardized Form | Unified Certification Form | Unified Certification Form | Unified Certification Form | Invoice / Recommended Form | Unified Certification Form |

| Validity Period | 2 year | 2 year | 1 year | 1 year | 2 year | 1 year |

Types of Issuance

Issuance by the Customs

-

KCS

Homepage -

Approval for the use of Customs Clearance Portal

-

Purchase of e-Certificate

-

Log in

-

Completion of C/O

-

Approval of Customs

-

Issuance (Print)

Issuance by the KOREA Chamber of Commerce and Industry (KCCI)

-

KCCI Homepage

-

Registration of Signature of the Applicant

-

Purchase of e-Certificate

-

Log in

-

Completion of C/O

-

Approval of KCCI

-

Issuance (Print)

Approved Exporter

Approved Exporters by the Customs authorities are granted the right to issue Certificate of Origin (KOR-EU FTA) and the benefits of submittingless documents, as having the ability to certify the country of origin of their products.

Benefits of Approved Exporter

| KOR-ASEAN / KOR-Singapore / KOR-India | |

|---|---|

| Before Approval |

|

| After Approval |

|

| KOR-EU | |

|---|---|

| Before Approval |

|

| After Approval |

|

| KOR-EFTA | |

|---|---|

| Before Approval |

|

| After Approval |

|

| KOR-Peru | |

|---|---|

| Before Approval | C/O self-issuance available when exporting USD 2,000 and under (available for preferential duty rate) |

| After Approval | C/O self-issuance available for only approved exporters when exporting over USD 2,000 |

| Others | |

|---|---|

| Before Approval | Not Applicable |

| After Approval | |

Types of Approved Exporter

| Type | Customs Aproved Registered Exporter | Customs Approved Registered Exporter by Item |

|---|---|---|

| Benefit range | Every agreement, and every item | Only on approved agreement for approved 6-digit HS CODE items |

| Validity Period | 5 years | 5 years (varied upon the compliance score) |

| Approving Authority | Main Customs (Seoul, Busan, Incheon, Daegu, and Gwanju), and Pyeongtaek Customs | |

| Approval Requirement | Ability to certify the country of origin Law Compliance by signatories | Ability to certify the country of origin Law Compliance by 6-digit HS CODE items |

Approvad Exporter Mark

Country of Origin Verification

A series of administrative procedure to check whether the goods meet the rule for the country of origin in accordance with Agreements or national law, and to imposepenalties to violators

Method of the Country of Origin Verification

| Agreements | Method | Verification Body |

|---|---|---|

| KOR-Chile | Direct Verification | Customs of the Importing Country |

| KOR- Singapore | Direct Verification | Customs of the Importing Country |

| KOR-EFTA | Indirect Verification | Customs of the Exporting (Observed by the Customs of the Importing Country) |

| KOR-ASEAN | (Principle)Indirect Verification (Exception)Direct Verification | (KOR) Customs, (ASEAN) Issuing Authority / Customs (SG, PH) |

| KOR-India | (KOR) Customs, (IN) Issuing Authority | |

| KOR-China | Indirect Verification, Direct Verification | Customs of the Exporting, Customs of the Importing Country |

| KOR-EU, KOR-Turkey | Indirect Verification | Customs of the Exporting |

| KOR-Peru | Indirect Verification, Direct Verification | Customs of the Exporting , Customs of the Importing Country |

| KOR- Colombia | Indirect Verification, Direct Verification | Customs of the Exporting , Customs of the Importing Country |

| KOR-Vietnam | Indirect Verification, Direct Verification | (KOR) Customs, (VN) Issuing Authority |

| KOR-US | Direct Verification, (Textiles)Indirect Verification | Customs of the Importing Country (Textiles) Customs of Importing/Exporting Country |

| KOR-Australia | Direct Verification, 호:간접검증병행 | Customs of the Importing Country, (AU) Issuing Authority |

| KOR-Canada | Direct Verification | Customs of the Importing Country |

| KOR- New Zealand | Direct Verification | Customs of the Importing Country |